Insurance reduces your financial risk by already having something in place to help pay (or fully pay or partially, in some cases) for the sudden expenses that might arise. This means that if you suddenly encounter an issue, you won’t have to drain your bank account to pay for it completely, so you can still keep up with car payments, mortgage payments and general daily living expenses. Insurance means your finances won’t be in shambles when life comes at you. For this reason, it is important to know what you are buying into and when should you buy insurance.

In this article, we will share with you everything you need to know about insurance.

Table of Contents

What Is Insurance?

At the end of the day, insurance is a way to manage those risks that life inevitably will throw at you. Insurance is a written contract between the insurer, the insurance company, and the insured, which insures you against uncertainties.

The policyholder may or may not be the life insured. A policyholder must be at least 18 years old in Singapore. When a mother buys hospitalisation insurance for her toddler, the toddler is the insured, while the policyholder is the mum.

When you pay into insurance, what you are paying into really is protection against any sudden financial issues that could arise from emergencies, illnesses and beyond. If you’re without insurance and are faced with a sudden emergency or accident, you may be left to pay the entire price.

How Does Insurance Work?

Insurance policies often have coverage for a certain amount of time, commonly called the policy term. When that term ends, you’ll need to buy a new policy or renew the existing policy. After you have purchased an insurance policy, the responsibility falls on you to pay a premium, which you can choose to pay monthly or yearly. Do note that policy terms (not to be confused with policy duration) may change, and premium may increase during policy renewal. For health insurance, existing conditions might not be cover, and the premium is usually tied to the age band.

You can also enhance your insurance coverage with optional riders such as the following

- Waiver of premium rider allows you to stop paying premiums and continue to get the coverage if the policyholder becomes permanently disabled.

- Accidental death rider, which pays you additional benefit in the event of accidental death

- Guaranteed insurability rider, which allows you to extend your coverage without the need of going through further medical examinations

Health insurance typically has a monthly premium, while homeowner’s insurance or auto insurance is commonly paid twice a year. The premium usually is directly related to how much of a risk the insurance company thinks you may be. The older you are, the higher the premium. No claim discounts are rewarded to those careful drivers who are seldom involved in accidents.

Premiums aren’t the only fee with insurance. Alongside the premiums, you may also have to pay a deductible. This is the amount of money you’ll need to pay before the insurance company picks up the rest in the event of an emergency. The is also copayment, which only kicks in when deductibles are met. The insured and insurance company copay a fixed portion of the payment.

We will illustrate using a $10000 hospital bill and insurance with a $3000 deductible plus 10% copayment. The life insured pays the first $3000 of the bill, after which the insurance company will pay 90% of the remaining $7000. Effectively, the life insured pays $3700, and the insurer pays $6300 of the bill.

Different Types of Insurances

Health Insurance

As its name suggests, health insurance will help you pay for any healthcare costs you may have if you become disabled, sick or injured. Some health insurance plans will give you cash payouts when you have an incident, while others will help pay some of the cost of nursing care or treatment.

There are five main types of health insurance plans, such as ones that:

- Cover your surgical and hospital costs

- Give you a fixed amount of money every day you find yourself in a hospital, usually, with a requirement on minimum, no hospitalization stays.

- Pay you a lump sum that will assist in covering expenses with critical illnesses, such as cancer.

- Replace your income if you become disabled and unable to work

- Pay for any long-term care you may need if you have a severe disability

If you have a family, are a senior citizen or are even young and healthy, health insurance is recommended for everybody.

Life Insurance

Term Life

Term life insurance plans give you coverage for a fixed period of time or a “term.” Should you become permanently disabled, fall terminally ill or die, the insured’s sum will be paid out to the beneficiaries. Should none of the above instances occur, then the policy will expire, and you do not get back any premium paid.

If you decide to stop paying your premiums, your coverage stops, leaving you without coverage. These are different from whole life plans in that there is no “surrender or cash value” that will be paid out.

Whole Life

Whole life insurance and term life insurance are different in the way whole life insurance is for a person’s entire life and not just for a fixed period of time. The premium is higher for whole life insurance, but there may be a higher payout in the event of a disaster. Certain policies may also offer fixed premium terms for lifelong coverage. When the payment of premiums is complete, the individual holding the policy will have insurance coverage for the rest of their lives either until they surrender the policy or pass away. The surrendering value may sometimes be higher than the total premium you pay.

Endowment Plan

Endowment plans are popular in Singapore. It offers stable and predictable returns aiming to beat yearly inflation. An endowment policy also has an insurance component. When the insured passes on during the policy terms, a lump sum will be paid out to the beneficiary, and any future premium may be waived.

Endowment plans are sometimes marketed as a savings path to help you meet a certain financial goal, amassing a great deal of savings over time. A small portion of the premium goes toward coverage, while the rest goes into investments. Endowment plans are usually capital guaranteed. Investors will get an assured payout amount higher than they invested. However, the death benefit is relatively low compared to life insurance, as the main purpose of an endowment plan is for wealth accumulation.

It is important to note that endowment products are sometimes marketed to customers as fixed deposits, but this is untrue. You may get lesser than what you put in if you were to terminate the endowment plan prematurely. Therefore, you should give plenty of thought before committing to one, understand how the endowment plan works and whether it is suitable for your financial needs.

These are the common types of endowment plans available in Singapore.

Participating Endowment

Your savings are pooled with other customers and invested by the insurance company in a fund. The fund invests a diversified portfolio of investments, like stocks, properties or unit trusts. You get to participate in the profit of the funds. This investment profit is shared with you and other policyholders through a yearly bonus.

Investment returns are non guaranteed. The insurance company will declare the bonus or dividend yearly. Once the bonus is declared, the amount is vested and adds to the value of your policy.

Non-participating Endowment Policies

This type of policy essentially guarantees cash values and maturity values. They are not entitled to any bonuses. Suitable for those who are more risk-averse and prefers more certainties in their investment.

Anticipated Endowment Policies

This type of policy is like a regular endowment plan save with cash flow in mind. A portion of the sum assured will be paid at an anticipated interval, and the remaining paid together with the accrued bonus at policy maturity. Both participating and non-participating plan are available for anticipated endowment policies.

General Insurance

General insurance is there to give protection to things you value most. The insurer pays the sum assured when the insured is damaged or injured.

Common types of general insurance includes

- Property insurance to protect the building, valuable house contents and even liabilities

- Travel insurance to cover any travel-related losses or damages

- Motor insurance for your vehicles

- A personal accident plan to provide benefits in the case of accidental death, disability and injury.

- Maid insurance which provides health coverage for your domestic helpers

Things to Consider Before Buying Insurance

Understand Your Own Needs

Before you choose to commit to any given insurance, make sure it fits your needs. Each type of insurance is designed to cater to one aspect of your life specifically. For example, if you get health insurance, it will only help with bills if you are hospitalized. If you choose life insurance, it will offer protection against financial hardship in the event of permanent disabilities or death. Critical illness insurance will help you with a lump sum payout once you are diagnosed illness such as heart attack, stroke, or cancer. It helps to pay for those expensive long term post-hospitalization treatments and expense when other health insurance may fall short. For this reason, it’s important to get specific with what you need before purchasing.

Meet Your Protection Needs First

Always prioritised your protection needs first before considering other types of insurance or investment. Many people find insurance to be something they don’t need because they pay premiums without getting anything in return at first, but it does not negate its importance. Insurance is the largest, sturdiest foundation of financial planning. It is a need and not a simple desire. You can’t effectively plan financially by only thinking about investments that will grow your money.

Affordability

Because insurance is the foundation of planning your finances, you should make sure it is affordable and fits your budget. In short, you need to understand what are your liabilities and how much coverage do you need. Ensure that the insurance you are purchasing is insurance that you can afford to pay the premiums on.

Without knowing how much to spend on insurance, it could lead to early termination of your policy, meaning you might have to give up that protection even though you really need it.

Understand the Terms and Conditions

Much like with anything else, you need to read and understand the fine print of insurance. Many people complain that the companies don’t pay out the amount they are supposed to, but this isn’t always true. As a policyholder, it is your responsibility to know what exceptions and exclusions come with your insurance. Common exceptions include outpatient medical care, pre-existing conditions and other things that you need to make it a point to learn about. These are conditions that benefits do not get paid under.

There are also certain benefits that you might not be aware of. For example, hand foot mouth Hand-foot-and-mouth diseases (HFMD) are covered under personal accident plans; breech delivery is paid for under some hospitalisation plans for pregnant mums. So be sure to understand your benefits and entitlements to make full use of your insurance plans.

Choosing The Right Financial Advisor

Since insurance is a part of your financial planning and will be with you throughout your life, you need someone you trust to help you navigate it. Having a financial advisor that you trust to guide you through the process will ensure the best results. When considering a financial advisor, consider that an ideal advisor will:

- Let you take the time you need to make decisions instead of trying to hard-sell products to you

- Make recommendations that are best suited to you based on your needs and life stages.

- Help you with updates about the changes to your policy

- Review the policy from time to time to make sure they fit your financial goals

Things to Consider Before Surrendering Your Insurance

For any given reason, people find themselves holding insurance policies that they are no longer in need of or do not want anymore. There could be several causes for this: the policy might be underperforming in terms of what they expected, the premium could be too high, or there is no need for the policy anymore. Surrendering then becomes an option.

Still, doing so may mean incurring fees for surrendering, which will naturally lower the amount of cash you’re receiving. And worse, you may get back lesser than the amount you paid for.

14 Days Free Look Period

If you just sign up a new policy, first thing is to check if you are still within the free look period.

Freelook provision is 14 days cooling-off period that allows you to cancel your policy and receive a full premium refund less medical and other expenses. The 14 free look period starts from the day you received the policy document and is applicable for all insurance policies except car, maid and travel insurances.

For investment-linked policies, you may suffer a loss (or gain) if the investment’s unit price has fallen (or increased).

Always review the policy documents, understand different policy terms and conditions and make sure it fits your personal and financial needs.

Premium Holiday

Premium holiday is something that is given in life insurances and endowment policies. It allows you to temporarily stop paying the premium for a short duration of time. It is commonly activated during periods of economic hardships, making it particularly useful for those who find themselves in between jobs or who have sudden financial emergencies to settle; however, certain conditions will often need to be met before this happens, and it will extend your premium term as well.

Policy Loan

If the policyholder needs to get access to cash in an emergency, they can get a loan on their policy. The loan comes from the cash value accrued throughout the policy years. Because the borrowing is against the policyholder’s assets, it is usually quick and simple to get approved. The funds can be used in any manner that the holder needs to use them. However, note that taking a loan from the cash value will also mean you need to repay it with interest. This means it will be more difficult for the savings to grow.

Partial Withdrawal

Besides a policy loan, policyholders can also make a partial withdrawal from the cash value of their policy. This is done by taking out part of the amount accumulated or taking some of the death benefits. Unlike a loan, the partial withdrawal is considered a surrender of some of the net cash amount of the policy. The action is unable to be reversed once you have sent it into effect.

Using Cash Value to Pay Premiums

Over time, whole life insurance policies accumulate cash. This is called the policy’s cash value. If you are having trouble paying for the premiums, you may be able to use the cash value to pay the premiums by having it deducted when the premium is due. You can also choose a reduced paid-up option, which will change the policy’s cash value for a smaller amount of a sum insured.

Traded Endowment (TEP), An Alternative to Surrendering

After careful considerations, If you ultimately decide to surrender your policies after evaluation of the above options. Then you should definitely consider Traded Endowment Plans.

What Is Traded Endowment/Life Plan (TEP/TLP)

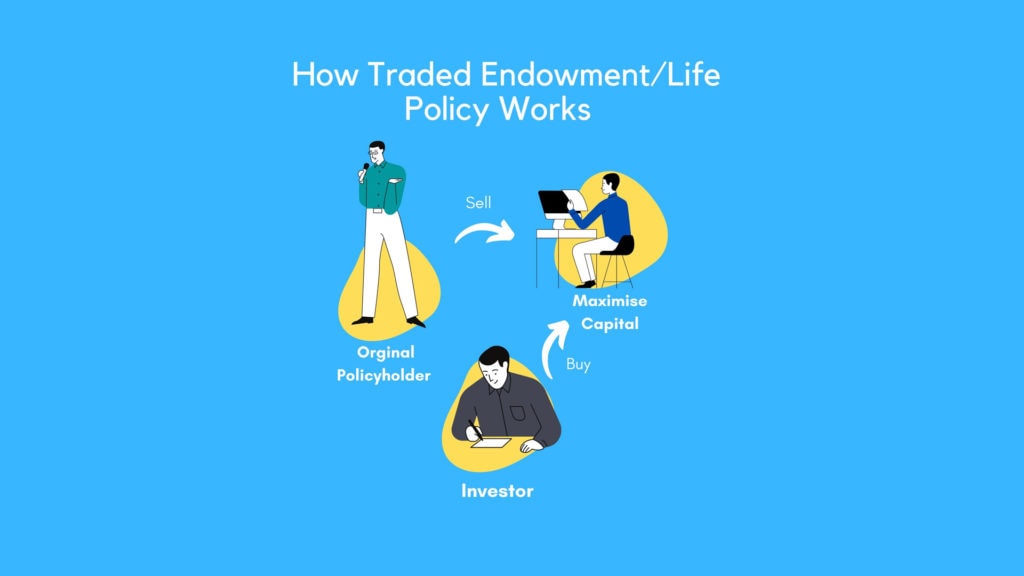

Traded Endowments Policies (TEP) or Traded Life Policies (TLP) is originated in the UK, and it is increasingly popular in Singapore since 2007. The traditional manner for policyholders to cash out is to surrender their insurance to the insurance company. TEP provides a secondary market where life policies are traded. The original policy transfers his policy to a new policyholder for a higher amount than the insurance company’s surrender value. This process is called an absolute assignment.

Today in the United Kingdom, it is mandatory for the insurance companies to inform those policyholders who want to surrender their policies on the options available, including resale endowment plan.

How Does Traded Endowment Plan Works

Mr Lee, in his mid-40s, took up a 25 years endowment policy for his retirement planning 17 years ago, and with 3 more years of premium to pay. He is considering surrendering his policy as he can no longer afford the premium, and he needs a lump sum cash due to unforeseen circumstances. The surrender value from the insurance company is only slightly above the breakeven point. Hence he decided to sell his policy to Maximise Capital which offers a higher cash value.

Mr Lee meets with Maximise Capital’s representative at the insurance company customer service to complete the policy transfer and receive the cash payout on the spot.

Marcus, an investor, decides to take over the policy from Maximise Capital. He will continue to service the remaining 3 years of the premium. He can maximise his return by invest directly into 17 years policy that has surpassed the breakeven point and enjoy a higher return in a much shorter time.

What Happens When You Sell Your Policies?

When you sell your insurance policy, the policy gets transferred to a third party through an insurance process called an absolute assignment.

There are a few things to keep in mind when doing this. The buyer (third party) will become the legal policyholder responsible for paying any future premiums if applicable. However, the life insured remains unchanged. This means the original policyholder will lose the coverage; the new policyholder receives the death benefit when the original life insured passes.

What Are The Benefits Resale Endowment Polices

For The Original Policyholder

- Higher Cash Value: The investor usually pays a premium on top of the surrender value for the legal rights of the insurance policy. Secondary market makers like Maximise Capital offer 5% to 10% above the insurer’s surrender value.

- Instant Cash: Get cash immediately after the policy is transferred

- Financial Relief: The new policyholder is responsible for any future premium payments

For Investors

- Captial Guaranteed: Like brand new endowments, a TLP is also capital guaranteed in sum assured and yearly bonus declared. You will get back more than what you paid for the premium when the policy matures, but with a much shorter waiting period.

- Attractive Returns: TEP offers higher yields to maturity than a brand new endowment plan as you save on distribution (Agent commissions and other operational expenses) costs which generally incurred during the initial years of the plan.

- Buying Time: Endowment policy typically has zero or low cash values during the initial years. It breaks even during the middle or towards the end of the policy, and investors only see a positive return when the policy matures. Buying a second-hand endowment plan allows you to buy priceless time, skip the first few years and invest directly in policy that has passed the breakeven point.

- Flexible Policy Term: You can choose from a policy term as short as 3 years or more than 10 years to maturity, invest according to your time horizon and financial needs. Diversify your investment portfolio with a traded life policy. It is a great way to plan for your children’s education or retirement, which cannot be compromised.

What Are The Risk Associated With Buy A Traded Life Policy

- Life Extension Risk: This is a risk of an insured outliving the expected life expectancy. As a result, the investor may have to pay for longer premium terms and reduce investment return. Life expectancy is difficult to predict; it is important to choose a plan with a fixed premium term.

- Foreign Exchange Risk: Policy benefits may be paid using foreign currencies if a foreign insurer underwrites the policy. With Maximise Capital, we only trade policies underwritten by established local insurers.

- Liquidity Risk: Like any endowment plans, you may suffer a loss if the policy is terminated before maturity.

- Credit Risk: If the life insurance company becomes insolvent, investors are at risk of the life insurance company which issued the underlying insurance policies. Only buy policies issued by reputable insurance companies you can trust.

It is clear to see why, to many that TEP is a win-win outcome for all the parties involved in the transaction.

Final Thoughts

Insurance is crucial to financial planning. Without it, you run a massive financial risk if you are faced with a sudden emergency, such as house damage, car damage or a medical incident. Having insurance will also safeguard you against financial catastrophe.

Insurance is a long term commitment; make sure you understand all of the fine print of the policies and can work with a financial advisor who you can trust in the matter. If you need to get out of the policy for one reason or another, they will be able to help you do so with the most benefits and the fewest penalties.

Leave a Reply